Our first multi-touch book, "Calculating Value at Risk – Instructional Guide to VaR" is now available for sale on the iTunes Store! A first effort of its kind in the world of Risk and Treasury management, the book combines the best of instructional design & practical hands on content with the power of the iPad learning platform. Easily downloadable to your device it brings high quality content with video lessons and self assessment quizzes in one neat, affordable package.

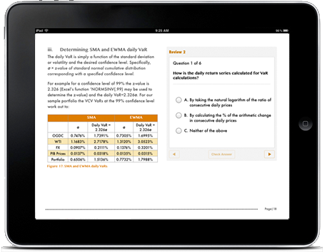

Designed for the iPad using Apple’s iBooks Author, Calculating Value at Risk provides a unique learning experience with instructor led video sessions that walk through detailed calculations using excel spread sheets and templates. Interactive review sections measure your progress and understanding of the course materials.

Figure 1 Video lessons and text examples side by side

- An introduction to this widely used and misunderstood risk management measurement tool.

- Step-by-step process for calculating VaR using Variance Covariance (VCV) and Historical Simulation approaches.

- Caveats, qualifications and limitations pertaining to the use of this metric as a measure of risk.

- A VaR case-study demonstrating the application of VaR in a non-traditional, market risk oriented application.

- The use of VaR as a tool to forecast and predict the margin shortfall problem within the oil, gas and petrochemical industry.

Figure 2 Easy self assessment

- 5 video sessions (over 73 minutes of video lectures) that walk through detailed VaR calculations in excel along with an interpretation of the numbers obtained.

- 5 review sections (MCQs format) to check the your progress and understanding.